Donor-advised funds began in the 1930s, but in recent years these funds have become the fastest growing vehicle in philanthropy. Contributions to donor-advised funds grew at three times the rate of total charitable giving in 2016 according to the National Philanthropic Trust.

Donor-advised funds defined: Donor-advised funds (DAF) are donor-established philanthropic funds that are maintained, operated and controlled by a sponsoring organization: community foundations, like the Hampton Roads Community Foundation, national funds like Fidelity Charitable and Vanguard, or single-issue charities like Tidewater Jewish Foundation. To establish a DAF, a donor makes irrevocable, tax-deductible contributions to the sponsoring organization and then recommends grants to approved charitable organizations.

Recognizing a gap in data and analysis about DAFs, Giving USA Foundation recently released “The Data on Donor-Advised Funds: New Insights You Need to Know,” a report analyzing DAF giving patterns against Giving USA reports and other national giving assessments.

Following the report’s release, I had the pleasure of moderating a panel of experts in a live Giving Institute webcast to discuss the report and the role that DAFs play in philanthropy. I was joined by Una Osili, Professor of Economics and Associate Dean for Research and International Programs, Indiana University, Lilly Family School of Philanthropy; Pam Norley, President of Fidelity Charitable; Dave Scullin, CEO of the Communities Foundation of Texas; Mike Geary, Attorney at Law, LLC, at Geary, Porter & Donovan, P.C. To purchase the full report, visit Giving USA.

|

(From left to right: Aggie Sweeney, Chair, Giving USA Foundation; Rachel Hutchisson, Chair, The Giving Institute; Dave Scullin; Pam Norley; Mike Geary; Una Osili; Keith Curtis, Founder and President of The Curtis Group.) |

Who is getting the funds?

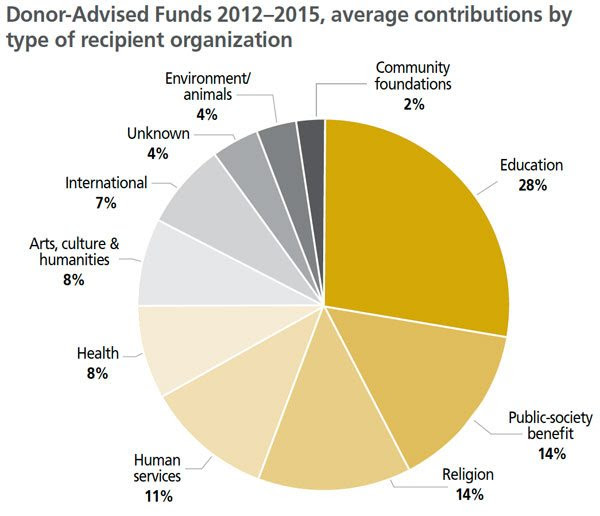

- Of the $390.05 billion contributed to charities in 2016, DAFs received over 5% ($23 billion) according to Giving USA: The Annual Report on Charitable Giving. There has been steady growth in contributions to, assets in, and number of DAFs created since 2008. In 2016, overall charitable giving in this country grew 2.7 percent over the previous year. In that same time, contributions to DAFs grew 7.6%, which is almost triple the overall charitable giving growth rate. Education, religion and public society benefit sectors historically receive the most dollars from DAFs.

For the most part, giving to and from DAFs largely reflects trends seen in philanthropy across the country. However, education, not religion, received the most dollars from DAFs. Also, arts and international sectors received larger shares of giving from DAFs compared to overall giving. These deviations from national trends more closely mirror high-net-worth giving trends as identified by the U.S. Trust Study of High Net Worth Philanthropy.

For the most part, giving to and from DAFs largely reflects trends seen in philanthropy across the country. However, education, not religion, received the most dollars from DAFs. Also, arts and international sectors received larger shares of giving from DAFs compared to overall giving. These deviations from national trends more closely mirror high-net-worth giving trends as identified by the U.S. Trust Study of High Net Worth Philanthropy.- DAFs are used primarily by individuals committed to philanthropy. Panelist Pam Norley, president of Fidelity Charitable, now the largest national charity, affirmed this commitment when sharing that 85% of donor-advisors at Fidelity Charitable are making grants to more than six different organizations annually.

Benefits of Donor-Advised Funds

- Create a Strategic Legacy: Donors can think strategically about disbursing funds not only during the upcoming year; but in future years.

- Ease Administrative Burden: Donors maintain a central record of giving through a DAF. DAFs are similar to a family foundation without the added administrative and filing requirements. Also, many nonprofits are not equipped to accept complex assets, but DAFs are able to do so.

- Provide a Bunching Strategy: In light of the recent tax reform, DAFs may be a giving strategy for those who no longer itemize every year. Bunching enables donors to increase their charitable contributions and itemize gifts every few years, while taking the standard deduction in other years.

Myths Busted

- Pledges: While it is true that a donor cannot sign a legally binding pledge from a DAF, a donor can sign a letter of intent, which will be adequate for nonprofits to recognize the gift.

- Donor Engagement: At The Curtis Group, nonprofits sometimes share that it is too difficult to build relationships with DAF donors. This could be because the award letter did not provide the donor’s full contact information, or your organization is tracking the gift under the DAF sponsor rather than the individual donor. Whatever the case, nonprofits need to be more strategic in identifying, tracking, and engaging with DAF donors. Donor-centered fundraising is critical throughout the fundraising process.

- Disbursement: Some DAF critics have concerns that donors are funding DAFs but not disbursing funds to nonprofits. You may hear terms like “dormancy,” “pay out rates,” or “warehousing of assets.” There are some donors who do hoard assets, but most do not. Panelists reminded us that DAFs are irrevocable, so funds will be given to the nonprofit sector, whether tomorrow or years from now.

How Can We Leverage This information?

- Invest in Donor Relationships: Nonprofits must build relationships with donors and not view the grant as transactional. Strong donor relationships will position nonprofits to provide insight about giving vehicles such as DAFs. Take this opportunity to ensure that your nonprofit is communicating thoughtfully, strategically and thoroughly. There is also a unique opportunity through DAFs to build relationships with DAF sponsors, so they are educated about the work of your organization. Schedule meetings with local community foundations.

- Personalize Donor Communication: Impact reports, invitations, and thank you letters should not be sent to the DAF disbursing the funds. To build relationships, stewardship efforts must be directed to the individual.

- Market DAFs as a giving tool: On your website and other materials that provide ways to give, you should mention that you accept donor-advised funds. It’s also a good idea to spotlight current DAF holders in your newsletter. But before promoting DAFs, make sure your information is up to date on sites like Guidestar. Details like your address, tax ID and legal name must be accurate.

- Increase Nonprofit Transparency: DAFs further highlight the need for transparency in nonprofits. As donors select nonprofits to support, DAF sponsors vet each nonprofit before disbursing grants. My colleague Wendy McGrady recently wrote an article about the importance of transparency for nonprofits.

At The Curtis Group, we are passionate about philanthropy. Due to the projected ongoing growth of donor-advised funds, we foresee DAFs playing an increasingly important role in philanthropy. As a donor and as a nonprofit, you need to be informed. With knowledge, we can continue our critical conversations, strengthen our nonprofits, and ultimately increase awareness about philanthropy and its vital role in our country.

Leave a Reply