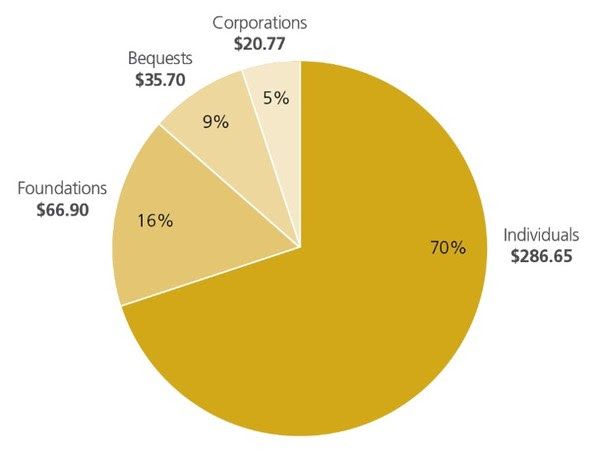

Powered by a booming stock market and a strong economy, charitable giving by American individuals, bequests, foundations and corporations to U.S. charities surged to an estimated $410.02 billion in 2017, according to Giving USA 2018: The Annual Report on Philanthropy for the Year 2017, released today.

Giving USA is the longest-running and most comprehensive report of its kind in America. It is published by Giving USA Foundation, a public service initiative of The Giving Institute, and is researched and written by the Indiana University Lilly Family School of Philanthropy.

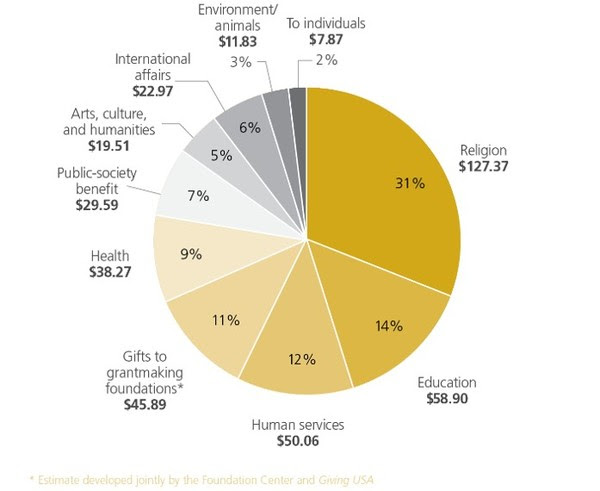

Americans have been and continue to be incredibly generous. It was not only a record-breaking year, but it is the fourth consecutive year of increased total giving, with overall increases of 5.2%. All four sources of giving (individual, corporate, foundation, bequests) were up, and eight out of nine of the recipient subsectors saw increases. The record-breaking donations and positive giving trends all exemplify the fact that Americans believe deeply in contributing to those nonprofit organizations about which they are passionate.

Here are the key statistics from the report as well as what we – at The Curtis Group – believe nonprofits should be focusing on to maximize their fundraising success.

Giving by Source |

| Giving by Sector/Recipient

|

Looking to the Future

|

The GoodStrong Economic IndicatorsEconomic indicators such as the S&P 500, Gross Domestic Product, personal income, personal consumption expenditures, disposable personal income and corporate pre-tax profits all drive giving in this country. In 2017, the above indicators all increased over 2016. Contributing to increased giving by individuals, both personal consumption and disposable personal income grew by over 4% last year as the economy continues to recover and household finances stabilized – especially for those at higher income levels. The S&P 500 finished the year way up, a 19.4% change over 2016. And signs point to continued positive trends in 2018. High-net-worth Giving Trends The Giving USA report also considers trends in the vehicles by which donors give, vehicles such as donor-advised funds and foundations, crowdfunding and online and mobile giving. Last year saw an increased diversification in the tools that donors are using to give. Technology is playing a part, and we are finding that donors are more strategic in the ways they are giving. Furthermore, we found that the small percentage of high-net-worth donors are not only more likely to make a major gift, but they are also more likely to utilize more sophisticated giving vehicles, making stock gifts, creating private foundations and donor-advised funds. When looking to the future, trends indicate that this small percentage of high-net-worth donors will continue to make a large impact on charitable dollars given in 2018. The UncertainImpact of Tax Reform Challenge of Donor Retention To ensure future growth, especially with a stagnant donor retention rate, it is even more critical that nonprofits engage their donors in innovative ways and invest in relationship-based fundraising. Influence of Political Climate on Donor Behavior What Should You Do?Nonprofits need to be prepared to engage their donors, especially their major donors, in meaningful ways, demonstrating impact, communicating and building relationships. Know Your Data

Invest in Infrastructure Engage Your Donors

|

I might have said it at the beginning, but it is worth repeating. Americans have been and continue to be incredibly generous. But, as nonprofits, we need to remember that they are not giving in a vacuum. They are giving to good causes, well-run organizations and strong leaders. Now is the time to engage your donors. Share the Giving USA results with your board. Demonstrate the impact of your work on the community.

Leave a Reply