On the heels of a decade of unprecedented growth, we celebrate the year for what it was – a complex year with incredible generosity. I could spend hours talking to you (but I won’t) about studies, statistics, shifts in giving patterns, the impact of the economy, the Tax Cuts & Jobs Act, public policy, and I will share some thoughts and insights in just a minute. BUT, before you read one sentence more, we need to celebrate the fact that Americans contributed over $427 billion dollars in 2018 according to Giving USA 2019: The Annual Report on Philanthropy for the Year 2018, released today. The big picture is that Americans are generous and giving remains strong, but was essentially flat.

On the heels of a decade of unprecedented growth, we celebrate the year for what it was – a complex year with incredible generosity. I could spend hours talking to you (but I won’t) about studies, statistics, shifts in giving patterns, the impact of the economy, the Tax Cuts & Jobs Act, public policy, and I will share some thoughts and insights in just a minute. BUT, before you read one sentence more, we need to celebrate the fact that Americans contributed over $427 billion dollars in 2018 according to Giving USA 2019: The Annual Report on Philanthropy for the Year 2018, released today. The big picture is that Americans are generous and giving remains strong, but was essentially flat.

So what influenced giving in 2018?

- A number of competing factors in the economic and public policy environments may have affected donors’ decisions in 2018, shifting some previous giving patterns.

- Many economic variables that shape giving, such as disposable personal income, had relatively strong growth.

- The stock market decline in late 2018 may have had a dampening effect.

- The policy environment also likely influenced some donors’ behavior.

- One important shift in the 2018 giving landscape is the drop in the number of individuals and households that itemize various types of deductions on their tax returns. This shift came in response to the federal tax policy change that doubled the standard deduction. More than 45 million households itemized deductions in 2016. Numerous studies suggest that number may have dropped to approximately 16 to 20 million households in 2018, reducing an incentive for charitable giving.

According to Amir Pasic, Ph.D., the Eugene R. Tempel Dean of the Lilly Family School of Philanthropy, “The complexity of the charitable giving climate in 2018 contributed to uneven growth among different segments of the philanthropic sector. With many donors experiencing new circumstances for their giving, it may be some time before the philanthropic sector can more fully understand how donor behavior changed in response to these forces and timing.”

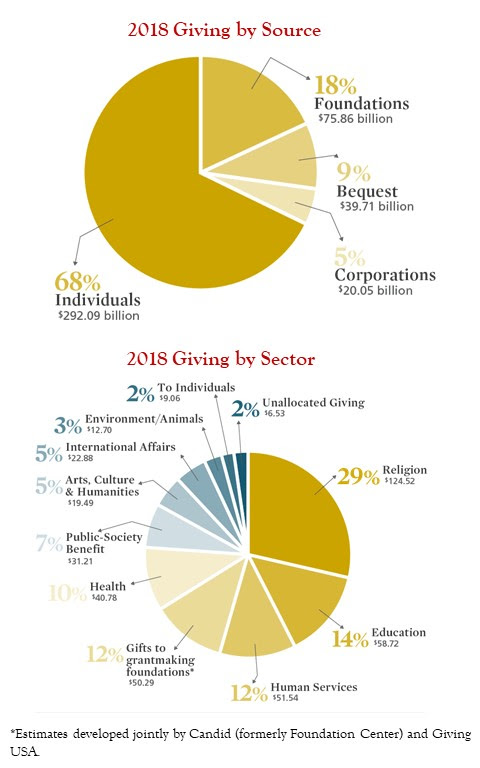

Highlights about Charitable Giving by Source

- Giving by individuals decreased as a percentage of total giving in 2018 to 68% (down from 70% in 2017), despite achieving its third-highest total dollar amount on record, adjusted for inflation.

- Giving by foundations had a record-breaking year, reaching its highest-ever dollar amount, and growing to its largest share (18%) of total giving to date.

- Giving by corporations experienced solid growth in 2018. This giving is highly responsive to changes in corporate pre-tax dollars and GDP.

- Giving by bequest did not keep pace with inflation.

Here are the key statistics from the report as well as what we – at The Curtis Group – think you should do with all of these national trends.

You Have the Numbers…

What Do They Mean and What Should You Do With Them?

- Individuals continue to be the largest contributors, giving more than 8 out of every 10 dollars (counting family foundations and bequests).

- Engaging your donors must be at the top of your to-do list. Nonprofits must build and maintain meaningful relationships with donors – particularly with high-net-worth individuals (who drive 50%+ of all individual giving!).

- Don’t forget to cultivate the middle tier of your donors. By conducting prospect research, cultivating, stewarding and building relationships with your mid-level donors, you will find individuals interested, willing and able to become larger donors to your organization.

- The verdict is still out as to whether it will impact donor behavior. But one thing is for sure; tax breaks and deductions are not the primary factors that drive philanthropy.

- Be prepared to discuss the latest policies with your donors. You don’t need to be their financial advisor, but you should be educated and prepared to help them find creative ways to support your organization.

Your personal experience counts.

- Knowing the national trends and data is important, but more important is knowing, understanding and using your organization’s fundraising data. What are YOUR trends? Do you know how much comes from individuals? Are more donors using family foundations and DAF’s at your organization? What is your donor retention rate and how can you increase it?

- Set goals and reach new milestones with this information.

- Be prepared to share the narrative of your organization; did giving increase or decrease? What were factors that contributed to this? Staffing changes? A capital campaign? Today’s donors are savvy and want to feel confident that they are investing in a well-run organization.

Be prepared to adapt.

- Demographics are shifting, giving vehicles are changing. Is your organization prepared to cultivate, solicit, accept and retain new types of donors and donations?

Leave a Reply